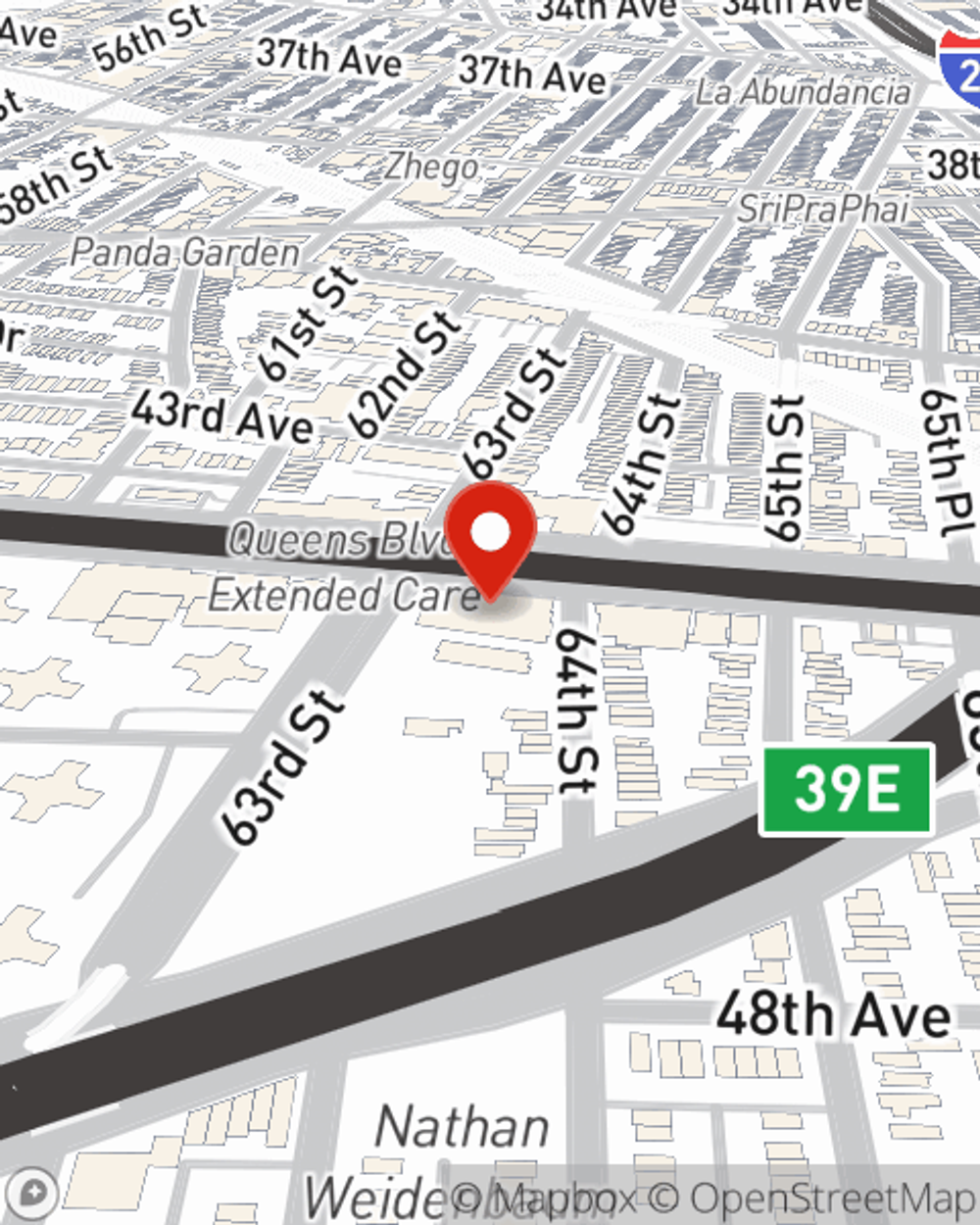

Business Insurance in and around Woodside

Woodside! Look no further for small business insurance.

Helping insure small businesses since 1935

Your Search For Great Small Business Insurance Ends Now.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Cynthia Koutsoliontos. Cynthia Koutsoliontos can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Woodside! Look no further for small business insurance.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your income, but also helps with regular payroll overhead. You can also include liability, which is key coverage protecting you in the event of a claim or judgment against you by a third party.

At State Farm agent Cynthia Koutsoliontos's office, it's our business to help insure yours. Visit our outstanding team to get started today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Cynthia Koutsoliontos

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.